Four common types of homebuying contingencies

Why do contingencies matter?

Buyer’s remorse is the worst. And since a new home may be the largest purchase you ever make, buyer’s remorse on a home purchase is a next-level kind of regret. If you’re a homebuyer looking at a new property, you want to feel confident that your investment is solid and your new home is up to snuff.

That’s why contingencies exist. A contingency is a condition you put in your real estate contract. Contingencies are protective mechanisms that give you an easy way out if certain situations occur.

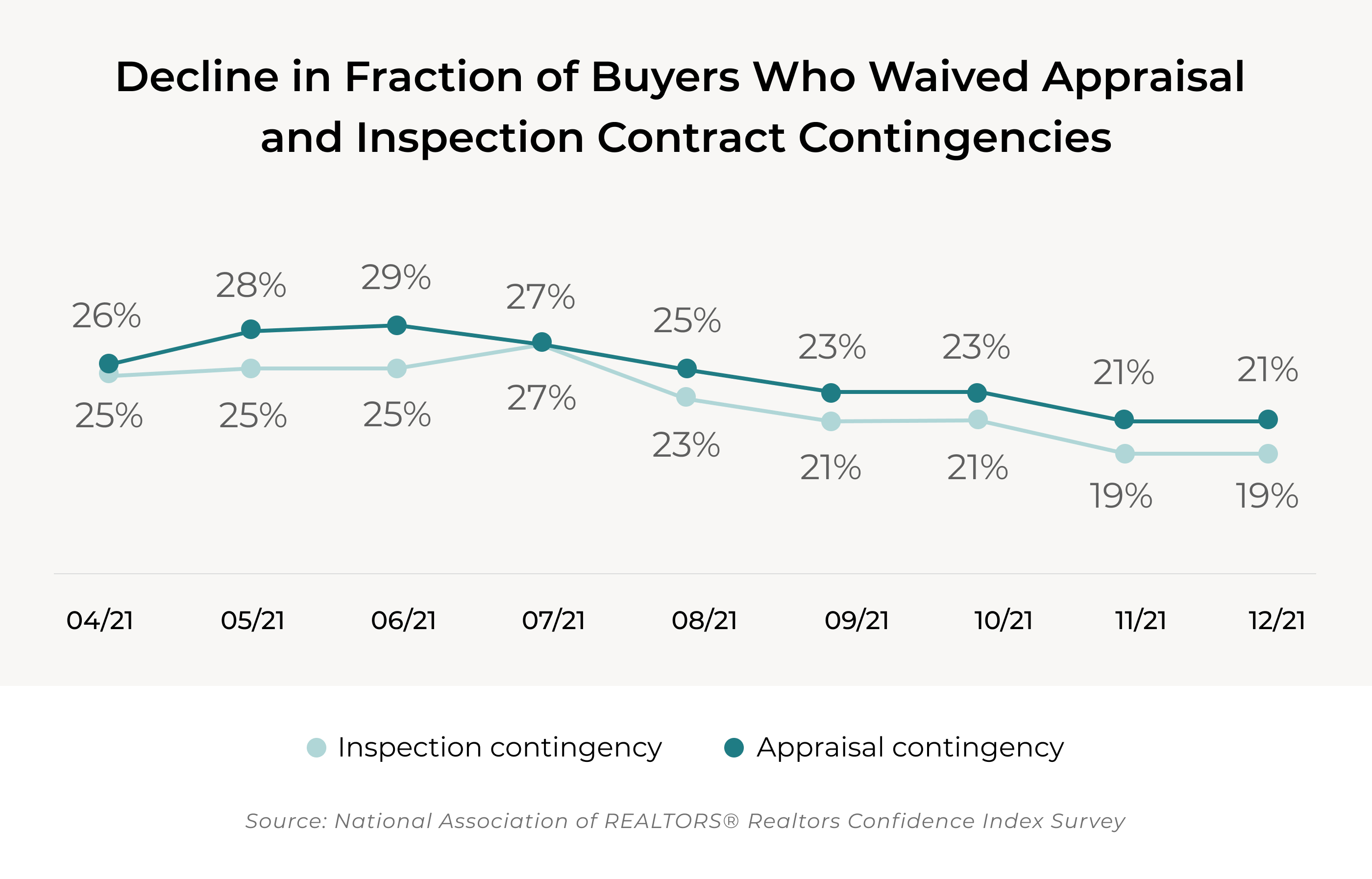

Contingencies are common in real estate transactions, although they tend to get “waived” more often in competitive markets. Data from the National Association of REALTORS® (NAR) shows that in 2021, contingency waivers peaked mid-year then began a steady decline.

While it may be tempting to wave contingencies to make your offer more competitive, you should always tread carefully because contingencies are one of the few mechanisms that protect you as homebuyer. “With a traditional offer, every homebuyer needs to strike a balance between ensuring appropriate contingencies to protect themselves while also putting a competitive offer on the table,” says Brian Gubernick, Homeward’s Chief Real Estate Officer. “That’s why we created The Homeward Cash Offer. It’s the lowest risk and most flexible way to waive contingencies.”

There are four common contingencies that every homebuyer needs to work through:

- Home inspection contingency

- Appraisal contingency

- Financing contingency

- Home sale contingency

Home inspection contingency

Home inspection contingencies are one of the most common home buying contingencies. According to NAR, around 80% of homebuyers include a home inspection contingency in their purchase agreement. Home inspection contingencies are one of the most common home buying contingencies. Katie Collins, Homeward’s Customer Experience Manager, says she’s surprised that many people waive this important contingency. “In a hectic, fast-paced, and emotionally overwhelming market, an inspection gives the buyer peace of mind and confidence in the transaction. They can waive this contingency, but that means they're assuming more risk."

When you include a home inspection contingency in your contract, you specify that you plan to have a certified home inspector inspect the property within a certain timeframe. As the buyer, it’s your responsibility to choose a home inspector and schedule the inspection.

According to Collins, you’ll typically add contingent language that allows you to terminate the contract if the inspection uncovers problems that the seller isn’t willing to negotiate or repair. If your inspector finds issues, you’ll request the seller to make repairs or lower the price of the property. Your contingency clause would specify how much time they have to respond. If the seller is unwilling to do either, then you have the choice of allowing the contingency to expire or terminating the contract and recovering your earnest money deposit.

When you use a Homeward Cash Offer to buy your new home, your home inspection will occur during the Homeward Purchase. Once the inspection is complete, you’ll work with your Homeward CX Manager and your agent to decide whether you’d like to move forward with the purchase and what repairs or price reductions you’ll request.

Appraisal contingency

An appraisal contingency dictates that your purchase contract is conditional upon the property being appraised to confirm its value for your mortgage lender. Before finalizing your mortgage, your lender will want to ensure that the purchase price you pay is in line with the home’s fair market value. Lenders typically use three things to determine appraisal values:

- Comparable, recent home sales (commonly known as ‘comps’)

- Tax records

- An in-person evaluation of the property by a third-party appraiser

If the appraisal comes back in line with the purchase price of the property, the sale will move forward. But if the appraisal comes in lower than the purchase price, you should connect with your loan officer to discuss your options. You might be able to restructure your loan to make the purchase work. If you’re unable to meet your lender’s requirements, your appraisal contingency allows you to rescind your offer without losing your earnest money.

A Homeward Cash Offer allows you to eliminate the appraisal contingency altogether. We’ll conduct a Preliminary Appraisal during the option period/due diligence of the Homeward Purchase, when we purchase the property on your behalf. When you’re ready to buy the property back from us — what we call the Customer Purchase — your lender will conduct a Final Appraisal.

“If you want to make a very aggressive offer and you are willing and able to waive the appraisal contingency, making a Homeward Cash Offer is the lowest risk and most flexible way to do that,” explains Brian Gubernick, our Chief Real Estate Officer. “It's low risk because your clients can see this Preliminary Appraisal during due diligence and use that to make a go/no-go decision. It's flexible because they can still move forward, even if that Preliminary Appraisal comes in lower than their purchase price.”

Financing contingency

A financing contingency (also sometimes called a mortgage contingency) protects you by ensuring you’ll be able to secure sufficient financing for your home purchase.

In the traditional homebuying process, most people get preapproved for a mortgage before they make an offer. You’ll include your preapproval letter within your offer to give the seller assurance that you can afford to pay for the property. But getting preapproved for a mortgage is different than having final approval, and that means that snags and delays can happen.

Your mortgage contingency is a clause that specifies that you can back out of the purchase if you’re unable to secure financing within a specific timeframe. You’ll typically include details about your loan (type, amount, maximum interest rate, and points limit) and the contingency timeframe.

If for any reason you’re unable to secure the necessary financing by the deadline, you’ll be able to cancel the transaction, recoup your earnest money, and walk away. The seller will then be free to re-list the home for other buyers.

Making a Homeward Cash Offer enables you to skip the mortgage contingency. You’ll be preapproved to shop for a home for up to a certain amount. Sellers prefer cash and cash-backed offers because they are more certain to close without any hiccups. That makes your offer more attractive than contingent offers.

“I tried winning bidding wars for a year with a regular mortgage company before coming to Homeward,” says Kyle of Georgia, who made — and lost — nine offers in nine months. “I won an offer as soon as I put in my offer with Homeward!”

Home sale contingency

It’s a classic dilemma: If you already own a home and you’re looking to buy a new one, do you sell your existing home first or try to buy a new one first? Figuring out the timing is tough.

You don’t want two mortgage payments. And if you’re like most Americans, a large percentage of your net worth is probably tied up in your existing home and you can’t unlock that until you sell your existing home first. This common situation is the reason home sale contingencies exist.

A home sale contingency gives you a specific amount of time to sell your existing home. If you’re unable to sell your home in that period, you’re free to withdraw your offer and recoup your earnest money deposit.

Homeward’s Buy before you sell solution was created to solve this challenge. We’ll purchase the home you want with cash before you sell your old home and allow you to move in as soon as we close on it so you don’t have to live in the old house while it’s on the market. As soon as you finalize your mortgage, you buy back the new home from us. And in the meantime, you have up to six months to sell your old home (and if you can’t, we’ll buy it from you for an agreed-upon price).

“I think this is the way to buy homes of the future,” says Nathan, a Homeward customer. “We were able to put in a cash offer with no contingencies, and then get the best possible price on our old home. It lowered our stress, made our purchase more competitive, and allowed us to get the best deal on our sale.”

Don’t let contingencies get in the way

Contingencies are an important safety mechanism for homebuyers, but leaning on them too heavily can result in a less attractive offer. As a homebuyer, you need to make the most competitive offer possible. So now that you know all about contingencies, here are some bonus tips on how to remove them from your offer. In the end, the best way to remove common contingencies is to make a Homeward Cash Offer.

If you're a homebuyer interested in learning more about becoming a cash buyer, schedule an appointment with a Homeward Advisor here.

If you're an agent interested in turning contingent clients into cash buyers, schedule an appointment with a Homeward Advisor here.